Brief analysis of the first quarter of the World Bank "Outlook for the Commodity Market"

According to the first quarter forecast of the "Commodity Markets Outlook" released by the World Bank:

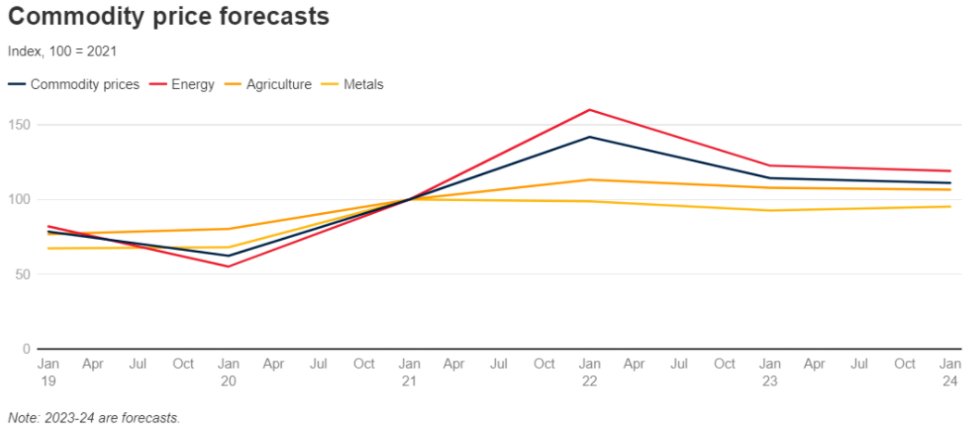

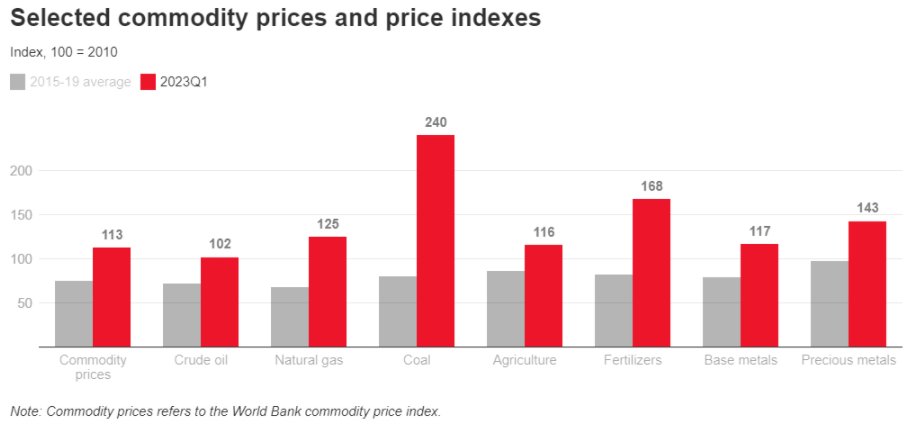

The price of commodities is expected to fall 21%this year, and it is basically stable in 2024. The expected price decline in 2023 is the biggest decline since the new crowd. The energy prices of 2023 are expected to be 23%lower than 2022, and will be roughly stable in 2024. The risk of prediction tends to rise, mainly because many factors that have recently caused impact on the commodity market still exist. These factors include the possible interruption of energy and metal supply (part of the reason for trade restrictions), the situation of geopolitical tensions, and China's industry exceeds expected expectations. Recovery and severe weather incidents. The disappointing global economic situation is the main downward risk.

The Price of Commodities is Expected to Fall 21%This Year, and It is Basically Stable in 2024. The Expected Price DeCline in 2023 is the Biggest DeCline SINCE The New Crowd. The Energy Prices of 2023 Are Expected to Be 23%LOWER than 2022 , And Will Be Roughly Stable in 2024. The Risk of Prediction Tends to Rise, Mainly BeCAUSE MANY FANY FATORS That Recently Cauty Impact on the Commodity Market Stt St ILL Exist. These Factors Include the Posses International Trade Restrictions), The Situation of Geopopolitical Tensions, and China's Industry ExceeEd Expectations. Recovery and Severe Weather Incidents. The Disappointing Global Economic Situation is the main double risk.

Oil prices have fallen from the peak of mid -2022, and are expected to remain stable in 2023. Although the fluctuations in March 2023, Brent oil prices are still 35%lower than the recent historical highs set in June 2022. After the group introduced the upper limit of the price, in December 2022, the discount price of the Russian oil benchmark price compared to Brent prices expanded 7 (G7) industrial countries. It is expected that the average price of Brent crude oil in 2023 is $ 84/barrel, which mainly reflects the weak growth prospects of developed economies. Petroleum supply will increase, but this process will be relatively slow due to OPEC+production quota and production capacity restrictions in most other oil -producing areas.

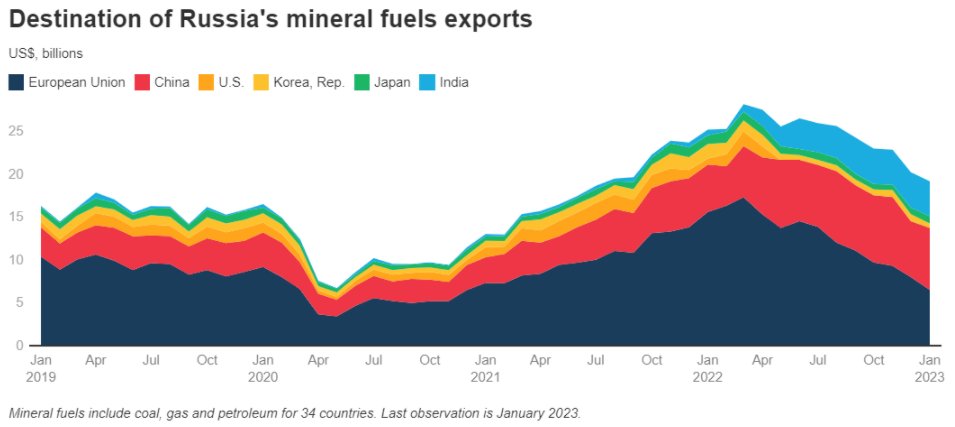

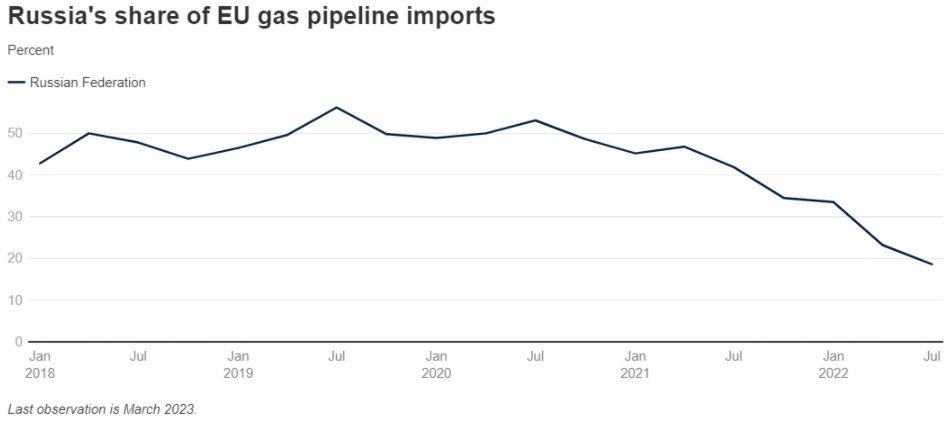

Although the decline in mineral fuel prices has affected Russia's export revenue, Russia's production and exports remain tough. Since April 2022, Russia's oil exports have remained stable, but due to the EU's import ban, its export volume is expected to decline this year. After the Ukrainian war, Russia shifted its oil, natural gas and coal exports to India and China, while reducing supply to the European Union, Britain and the United States.

Due to weak demand, natural gas prices fell. European natural gas price benchmarks plummeted 80%compared with the peak in August 2022. The reason is that the winter weather is milder than expected, the import of natural gas (LNG) of LPG (LNG) has surged, and all parties have worked together to improve energy efficiency and save energy. Large export volume and the reconstruction of trade routes enable natural gas and coal markets to adapt to the interruption of supply caused by Russia's invasion of Ukraine. Due to the increasing attention to energy security, especially in Europe, the reduction of natural gas supply in Russia and the changes in the LPG's natural gas trade model may continue for a long time.

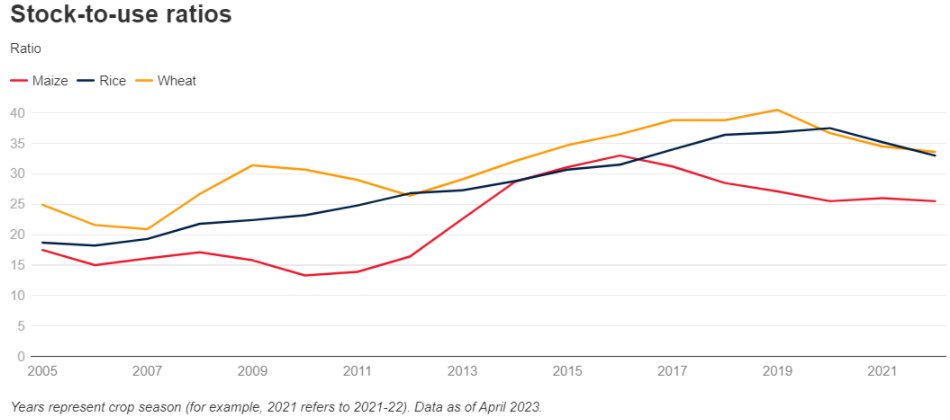

The supply of major grain products has improved, but risks still exist. The update of the Black Sea Food Initiative continues to help Ukraine's grain exports into the global market. The increase in the harvest of other major grain production countries and the decline in energy prices have helped fall agricultural prices from the peak value of early 2022. The inventory consumption ratio of grains has declined, but it is still sufficient. This ratio is a rough indicator for grain supply relative to expected demand. The risks that may lead to the continuous upward trend of global grain prices are: the possibility of more trade restrictions, the intensification of geopolitical tensions, and the increasing weather conditions such as the phenomenon of El Niopy.

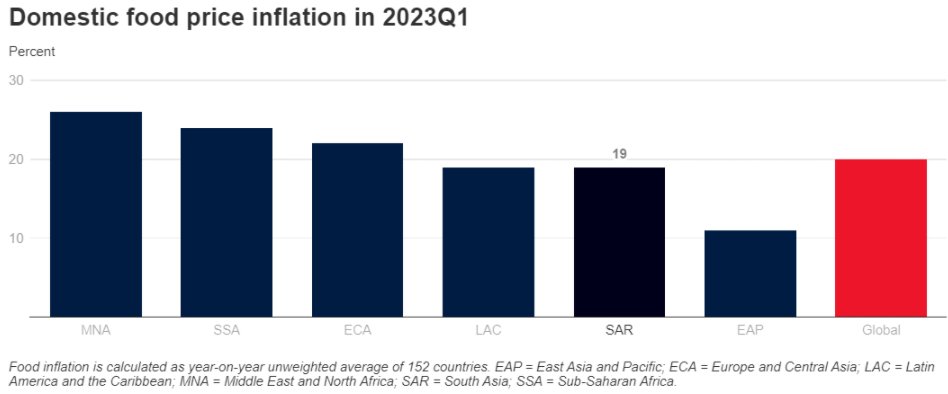

Although global food prices have fallen, the inflation of food prices in some countries still exist. Food prices are expected to decrease by 8%in 2023 and 3%in 2024. Nevertheless, the food price index adjusted by inflation will remain at the second highest level since 1975 -only in 2022 surpassing this level. In addition, global food price inflation is still high. In the first quarter of 2023, the average increase in domestic food prices in the world was nearly 20%year -on -year, the highest level in the past 20 years. For emerging markets and developing economies (EMDE), the number is roughly the same, but there are great differences between countries.

It is expected that metal and mineral prices will remain stable during the predicted period, but there is long -term upward risk. Driven by the rise of iron ore and tin, metal and mineral prices rose by 10%in the first quarter of 2023 (month -on -month). This reflects the optimism of people's strong recovery and the improvement of the global growth prospects at the beginning of the year. Compared with 2022, the price is expected to decrease by 8%in 2023, and further declined in 2024. The main risks of price forecasts include the recovery of China's real estate industry than expected and supply interruption, including interrupt restrictions caused by trade. However, in the long run, energy transformation may significantly improve the demand for certain metals, especially lithium, copper and nickel.

Origin from: World Bank